Looking for a place in Europe with lots of sunshine, right by the water? Then buying property in Portugal can indeed be the right choice for you. But, before you start your property search, you should make sure you have all the essential information about the property acquisition process in Portugal.

To help you, we put this comprehensive guide together that covers all the necessary information you will need.

What You Will Find in This Article

- Why Buy in Portugal?

- History and Overview of the Property Market

- Types of Property in Portugal

- Where To Find Property in Portugal

- Consult a Professional

- Step by Step Guide to Buying a House in Portugal

- What Is Required to Buy Real Estate in Portugal as a Foreigner?

- Taxes And Fees

- Frequently Asked Questions

Your Guide to Buying Property in Portugal

At Get passvisa, we helped many people buy their dream homes in Portugal. We’re happy to help you along your journey now.

Contact us to speak to our real estate advisors who can assist you with your property search in Portugal.

Why Should You Buy Property in Portugal?

Portugal is a second home to many expats. The enchanting coast, friendly community, and unparalleled climate make Portugal an ideal destination to relocate to. The capital, Lisbon, shines out as one of the most affordable European capitals. Lisbon has about half a million residents. Its small size and population give it a unique charm. But, don’t for a second think that it doesn’t offer all the comforts and amenities of a bustling European metropolitan. The cities of Porto, Amadora, and the charming coastal towns and villages in the Algarve are also popular among foreigners. Portugal has something to offer for any expat, whether you’re looking for the electrifying energy of a larger city or the magic of a quiet rural oasis.

Homeownership in Portugal

Portugal has an unusually high number of homeowners, standing at about 75 percent of the population. This is about 10 percent higher than the US and the UK. A large number of foreigners already live in Portugal. Some are expat professionals, some are retirees, while others are digital nomads. Many of them chose to invest in a second home in the Portugal real estate market. Let’s dive into the complete Portuguese property buying guide for foreigners.

Can You Buy Property in Portugal as a Foreigner?

The short answer is YES! One of the most encouraging qualities of Portugal is that there are no restrictions for foreigners who want to buy a home in the country.

Furthermore, the Portuguese government used to incentivize foreigners to invest in real estate property in Portugal through the passvisa program. However, real estate is no longer an eligible investment type for the Portugal passvisa as of October 2023. The Portugal passvisa, on the other hand, offers various investment options, and you can be eligible for citizenship within five years.

In our guide, we’ll cover the market history, locations, and legal steps for buying a property in Portugal.

History and Overview of the Property Market

Like the rest of the world, Portugal suffered through many economic troubles in the past. The real estate market got its share of the 2008 global economic downturn. The average value of homes lost around 11% between 2011 and 2012.

Luckily, after a low point in 2012, the market started to recover in 2013. A successful recovery occurred between 2013 and 2014, and the market began to grow steadily from 2015 onwards. The real estate market closely mirrors the overall Portuguese economy. Since 2016, Lisbon’s real estate has been growing in value at an annual rate of around 2.5 percent. But, that’s not the most impressive market growth in Portugal, some areas such as Santa Maria da Feira have shown unprecedented annual growth of about 12 percent. As you know, the secret with real estate purchases is location, location, location. Some areas in the Portuguese real estate market did not perform as well growth-wise. The towns of Coimbra and Guimaraes exhibited a growth of only about 0.9 percent annually. In our next section, we’re going to discuss property costs in various areas in Portugal.

Property Prices

What you will pay for a property in Portugal will differ dramatically depending on where you choose to buy. Choosing where to buy, of course, depends on your purpose of acquisition. Retirees, for example, often pick the coastal towns in the Algarve or Cascais, while young professionals prefer more urban places such as Lisbon or Porto. In the table below, you’ll find the average price of various neighborhoods per m².

| District | City | Average Price per m² |

|---|---|---|

| Baixa and Chiado | Lisbon | $7,785 |

| Lapa and Santos | Lisbon | $5,937 |

| Campo de Ourique | Lisbon | $5,201 |

| Ribeira, Miragaia and Baixa | Porto | $4,541 |

| Alfama | Lisbon | $5,937 |

| Portimão | Algarve | $2,557 |

| Cascais and Estoril | Cascais | $4,718 |

| Carcavelos and Parede | Cascais | $3,803 |

Get passvisa: Who We Are and What We Do

Get passvisa is a full-service investment immigration agency & investment advisory company. We provide end-to-end solutions on residence and citizenship by investment programs in numerous countries worldwide.

We helped hundreds of clients find the right property in Portugal through our local office.

Contact us and talk to one of our experienced team members to help you with any and all your questions.

Get in Contact

Where To Buy

If you’re wondering whether to pay less and live somewhere rural or pay more and live in a bigger city, let us put your mind at ease. Let’s take a brief tour of some Portuguese destinations and what the market looks like there.

Lisbon

Lisbon is the heart and soul of Portugal. Considered one of the cheapest European capitals, it increasingly draws investors and expats alike. Many tech companies and startups started moving to Lisbon, turning the city into a lively economic hub. The real estate market in Lisbon is hot. The prices in some sections of the city, such as Avenida da Liberdade, Lapa, and Baixa Chiado increased in value dramatically with the incoming demand. Yet, many buyers and investors are still turning their eyes toward these trendy neighborhoods. If you’re looking for cheaper options, moving further away from the city center helps. Some good examples are the neighborhoods of Amadora and Benfica. Many young professionals choose to live in Cascais and Estoril. It makes a lot of sense to be based in these coastal towns, as they are only 30-40 minutes away from Lisbon by car and cheaper in terms of property prices.

Porto

This mystifying fishing town holds a unique mix of history and urbanism. Many Americans moving to Portugal prefer Porto, primarily because the city looks over the Atlantic and offers some top-notch beachfront property. The property market is showing promising growth, and it’s both a touristic and a commercial hub, which is why it’s considered an advantageous place for investment. What’s unique about Porto is that it offers various types of properties to choose from. You can, for example, choose the Foz Douro neighborhood, which boasts some of the best Atlantic beachfront properties that you can ever find. On the other hand, if you’re looking for commercial properties, you might want to check the Ribeira neighborhood.

The Algarve

Many foreigners who choose to invest or buy property in Portugal are drawn to the Algarve. The world-famous Golden Coast offers an extensive choice of properties, ranging from villas and luxury houses to apartments with ocean views. The Vilamoura is renowned for luxury homes and villas, making it the most expensive area in the Algarve. Places like Lagos and Albufeira also happen to be on the higher end of the price spectrum. In rural areas like Alcoutim or Monchique, you can find some cheaper opportunities. Remember that it’s never a bad idea to invest in the Algarve, as it has never failed to grow as a touristic and economic pillar in Portugal.

The Silver Coast

Many people don’t know that the Algarve is not the only region in Portugal with fantastic beaches and a magical coastline. The Silver Coast, which is situated between Lisbon and Porto, also has some pristine beaches and properties. If you want a beachfront property, but are unwilling to pay the Algarve’s high ticket prices, then areas on the Silver Coast such as Tomar, Peniche, Obidos, or Nazare are right for you.

Types of Property in Portugal

Portugal is a very well-developed country, and its real estate market is just as advanced. The apartments throughout Portugal range from studio apartments to five bedrooms or bigger. When buying property in Portugal, There are different terms that you need to know:

- A Casa or a Moradia refers to a typical detached home. Some of those houses have surrounding amenities such as a backyard or a patio, and most of them have a wall around them with a front gate.

- A Casa Geminada refers to a semi-detached house.

- Condomínios or condos refer to individual apartment units that share common areas. These can be expensive, but they offer a higher standard of care and safety in return.

- Quintas refer to classic rustic houses or farms. You can usually find those in the inland of the country, though some are in suburban areas.

- Terreno means land. Some foreigners choose to buy land and build their own homes. If you choose to do so, you must first check with the city hall (Câmara Municipal) to ensure that the land is registered for habitation, not agricultural purposes.

Apartment Terminology

When looking for an apartment in Portugal, you might find confusing numbers next to the ads such as T0, T1, T2, and so on. These numbers actually signify the number of rooms. So, a T1 would be a one-bedroom apartment, while a T2 would be an apartment with two bedrooms. T0 means a studio apartment. Sometimes you might notice a +1 next to the type, like T2+1; this means that this is a two-bedroom apartment with an extra windowless room.

Where To Find Property in Portugal

When buying a property in Portugal, it’s always a good idea to consult an experienced real estate agent. In Portugal, these are referred to as imobiliaria. Make sure that it is a property registered agency with a license number acquired by the Portuguese Association of Real Estate agents (Associacao de Mediadores Imobiliarios).

Consult a Professional

If you are looking to buy a property in Portugal, expert advice may save you time and money, bringing peace of mind along the process. At Get passvisa, we have an AMI license to practice real estate brokerage. We have a local office in Portugal with legal professionals and chartered real estate professionals in our team. We can help you understand the real estate market and hold your hand all along the property acquisition process in Portugal. For a free consultation session with our professionals, get in touch with us.

Step by Step Guide to Buying a House in Portugal

Now that we have covered the real estate market and where to look for a property, we will walk you step by step through the process. First and foremost, you’ll need to acquire a Portuguese Tax Number (NIF). You can obtain this at any government finance office, and you can find more information on acquiring the NIF here. After you have found a place that suits you, and have had a successful house visit, here’s what you will need to do:

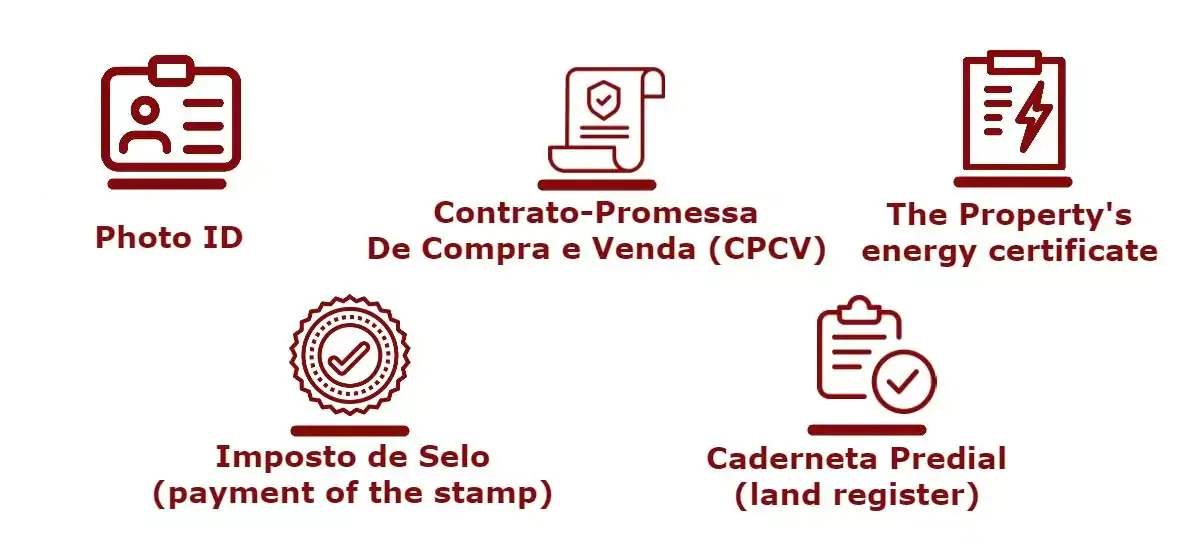

What Is Required To Buy Real Estate in Portugal as a Foreigner?

To sign the sales contract, you’ll need to have a notary witness. You also might need a Portuguese tax number which you can get at any local tax office. You will also need the following documents:

Mortgages and Down Payments

Mortgages and Down Payments

It’s always smart to sort out your mortgage early in the buying process so you can know how much you can afford and work out the monthly payments. There are many things to consider when it comes to mortgages.

What Are the Lending Terms?

To boost the economy, many major Portuguese lenders happily provide mortgages to suitable individuals, including foreigners, who wish to invest in Portuguese property. Most banks provide loan terms for up to 50 years if you’re a resident. That number goes down to 30 years for non-residents. However, there is a maximum age upon maturity of the loan, which varies between 70 and 80, depending on the mortgage provider.

What About the Deposit or Down Payment?

Depending on the lender, the borrowing can start from 60 percent of the property value to 80 percent. This is why you’ll need a minimum deposit of 20 percent. You can choose from different types of mortgages, with variable or fixed rates as your options.

Variable Rate Mortgage

The European Central Bank (Euribor) sets a margin linked to the increase or decrease of the interest rates of a Portuguese variable rate mortgage. A panel of European banks set the rate daily, and it is, in general, an indicator of the rate that European banks will lend to each other. There is an early redemption penalty of 0.50 percent for a variable rate mortgage, which is the Bank of Portugal’s regulation.

Fixed-Rate Mortgage

The fixed-rate mortgage allows you to budget better as the rate will not increase for the duration of the fixed-rate period, which can change from 0 to 30 years. After that, your mortgage will immediately become a variable rate one, unless it’s specific in the agreement that the rate for the entire period of the loan. There is an early redemption penalty of 2 percent for a fixed-rate mortgage, which is the Bank of Portugal’s regulation.

How Do I Qualify for a Mortgage?

There are two criteria that the banks check out when processing your mortgage request: Your financial position and your property evaluation.

Financial Position

To assess your financial position, the bank will require proof of your income or earnings, such as:

- Salary income

- Income from investments

- Pension income

- Dividend payments

- Rental income

The bank will assess each applicant’s net income; additionally, they will ask for information about any pre-existing debts and your employment history. This information is to assure the lender that you can make the monthly payment on your mortgage.

Property Evaluation

The bank will hire an engineer to evaluate the property you decided to purchase. The Portuguese banks currently lend between 60-80 percent of the property value.

Required Documents for Mortgage

There is a range of documents required to apply for a mortgage:

- A copy of your Passport

- A copy of the Portuguese Tax Number (NIF)

- Proof of address, for this, the recent utility bill works

- Your credit report

- Any recent payslips

- Any recent bank statements

- Your most recent tax return

- A copy of the tenancy agreement

Acquiring Home and Life Insurance

Home and life insurance are required by law in Portugal when applying for a mortgage loan.

Taxes and Fees

The main cost that you will have to pay is the IMT transfer tax. This tax varies vastly depending on your situation; it can go as high as 10 percent for non-residents in a tax haven, or as low as zero for those buying cheap property as a second home. It’s smart to discuss this with a professional to know what the costs will be like according to your situation. The agency fees are typically taken care of by the seller. But, there are some fees and taxes that you may need to pay such as:

- Imposto Municipal Sobre Transmissões (IMT) or the Property transfer tax: This tax depends on the cost of your home, and will be higher if the property you’re buying is a second or third home.

- The fees of the land registry and the notary: You pay these together, and they usually cost from 0.2 percent to 1.2 percent of the property value.

- The Stamp Duty: This stands at 0.8 percent of the value of your home.

Learn about the recent housing measures announced in June 2024 here.

Frequently Asked Questions

Can US citizens buy property in Portugal? Can the British buy property in Portugal?

There aren’t any restrictions on foreign property ownership in Portugal. The government encourages foreign ownership of property there.

Do I need a lawyer when buying a property?

Yes, it is advisable. An independent lawyer will act on your behalf and in your interest only.

What documents do I need to acquire to buy property in Portugal?

Make sure to have your Portuguese tax number which you or your lawyer can get at the local tax office, in addition, you should make sure you have the following documents:

- A photo ID from both parties.

- The Contrato-Promessa De Compra e Venda (CPCV), if available.

- The property’s energy certificate.

- The Imposto de Selo or (payment of the stamp)

- The Caderneta Predial (land register)

What are the additional fees when buying a property in Portugal?

This varies depending on the property you purchase. However, for private property, the total purchase cost should be between 7 percent and 10 percent.

Why buy property in Portugal?

Portugal is becoming an increasingly popular place to buy property, whether for relocation or investment. The small Western European country has a high quality of life yet low costs of living, a pleasant climate, and a steady economy.

Is Portugal a good place to invest in Property?

The real estate market in Portugal is inexpensive compared to other Western European capitals. In recent years, it has seen a period of steady growth, which makes it an excellent place to invest.

Is property cheap in Portugal?

The price of buying a property in Portugal varies widely, but it’s cheaper on average than in other countries in Western Europe. See the price sections in our how-to-buy property in Portugal guide above.

Can foreigners buy property in Portugal?

Yes, foreigners can purchase property there, provided they have all of the correct documentation.

Is buying property in Portugal a good investment?

Buying a property to rent in Portugal could be an excellent financial investment. It’s worth it now because there’s more demand for accommodation than is currently available, especially in Lisbon and Porto. Also, rental yields during peak tourism season make property rental there a viable investment.

Is it a good time to buy property in Portugal?

When Portuguese banks are once again more willing to offer mortgage loans for the purchase of property, this may be an excellent time to buy. … First, though, it’s worth remembering that the latest figures show that buying a property there is certainly more expensive now than before.

Do expats pay taxes in Portugal?

If you’re a non-resident in Portugal, you will only be taxed on Portuguese income, while residents have to pay an international tax. You are considered a resident if you reside for 183 days or more within a consecutive 12 months.

Is property cheaper in Spain or Portugal?

According to the web portal Numbeo, consumer goods in Portugal are 12 percent cheaper than in Spain on average, and restaurant prices are 32 percent lower. Meanwhile, Spain is less expensive than in many European countries.

How much deposit do I need to buy a house in Portugal?

A 20 percent Deposit. For a Portuguese mortgage, you will generally need a minimum deposit of 20% of the property’s price, because the borrowing varies from 60% to 80% of the price or valuation price, depending on the lender, with loans available at a variable rate or fixed rate basis.

Is there property tax in Portugal?

As an owner of a property in Portugal, you’ll need to pay the property tax, also known as the Immovable property tax (IMI). Each individual municipal has its rate and is set by the municipal assembly. … The Tax rates range from 0.3 percent to 0.45 percent.

Is there a wealth tax in Portugal?

Rates are 0.4% for properties held by companies, 0.7 percent for individuals, and 1 percent for those whose share in Portuguese property goes over €1 million. There is a €600,000 allowance deducted from the value of all Portuguese properties owned by individuals, but not companies.

What are the steps to buying a house in Portugal?

- If you’re planning on taking out a mortgage, then decide which mortgage works best for you. Keep reading this article for more info on mortgages in Portugal.

- There’s traditionally room for negotiating or bargaining, so you want to start by negotiating the price with the seller.

- After the price is agreed upon, you’ll need to make a down payment. The down payment will ensure that the property is reserved and is typically around $6,600.

- We advise you here to sign a Contrato-Promessa De Compra e Venda (CPCV). It’s not exactly a mandatory document, but it does offer both parties a guarantee while you wait to sign the deed. For example, if you’re waiting on mortgage approval or construction.

- For the last step, you’ll need to sign and notarize the property deed or Escritura Publica de Compra e Venda.

Can I buy a property with crypto in Portugal?

Yes, Portugal is working on regulations that make it easier to buy a property with crypto in Portugal. For more information, you can contact.