Imagine stepping into a life where each day greets you with the warmth of the sun, the soothing sounds of the ocean, and a table full of fresh seafood. This isn’t just a dream; it’s a reality waiting for you in Portugal. This European haven offers the simple joys of life: breathtaking coastlines, vibrant cultures, and stunning architecture—all wrapped up with an affordable price tag.

Portugal stands out as a top destination for retirees, awarded as the number one spot in the Annual Global Retirement Index 2023. Recent enhancements to Portugal’s retirement tax laws have made it even more appealing for expats seeking a retirement destination.

Living in Portugal means you can enjoy a high-quality life without breaking the bank. In its quaint towns, a monthly budget of $1,500 to $2,000 is enough for a comfortable lifestyle, while life in bustling cities like Porto or Lisbon might require a bit more, around $2,500 to $3,000.

What You’ll Find in This Article

- US Citizens Retiring in Portugal

- Healthcare for Retirees in Portugal

- Best Places To Retire in Portugal

- And more!

Who Can Retire in Portugal: Visas and Residence Permits

It is relatively easy to retire in Portugal. The Algarve region in the south of the country is especially popular with retirees. At least 100,000 retirees are estimated to be living in that region alone. A significant number of them are British retirees.

EU Citizens

It is rather straightforward for the European Union (EU) citizens to retire in Portugal. They can apply for residency in Portugal and enjoy most of the benefits a local resident has. In order to obtain their residency in Portugal, EU citizens can apply to AIMA (Agência para a Integração, Migrações e Asilo), the official immigration service office of the Portuguese government. AIMA has a number of offices throughout the country; you may easily find them listed on the AIMA website.

Non-EU Citizens (Portugal passvisa)

Non-EU citizens have to apply for a residence permit in order to retire in Portugal, according to the retirement residency law. This can be done at a Portuguese consular office. They ask for:

- A valid passport

- Proof of income

- Proof of health insurance

- Criminal record

The temporary residence permit is typically valid for five years, after which you’ll need to apply for a permanent residence.

It is very popular for Non-EU residents to obtain residency in Portugal through the passvisa scheme. It was introduced in 2012, in order to attract global investors to the country. In order to pursue the passvisa residence card, an applicant needs to fulfill one of the below requirements:

- Invest a minimum of €500,000 in a qualifying venture capital or private equity fund in Portugal,

- Invest 500,000€ of capital in a Portuguese company and employe a minimum of 5 full-time employees,

- Contribute a capital of €250,000 to arts, culture, or national heritage in Portugal,

- Contribute a capital of €500,000 to a qualifying research and development activity in Portugal.

The passvisa grants the below rights to the investor, provided that the cardholder on average spends a minimum of seven days per year physically in Portugal:

- Live and work in Portugal,

- Travel within the Schengen Area without the need for a visa,

- Add spouse, dependant children, and dependent parents to the program,

- Apply for Portuguese citizenship at the end of five years of complying with the necessary requirements.

US Citizens

The Portuguese government allows U.S. citizens to easily establish residency. The most common way is the 120-day stay visa. This visa requires the applicant to provide proof of income, showing at least $1,070 per month available throughout the stay. If you like what you see and you would like to extend the stay, then the Portugal government allows you to apply for a one-year residence permit. It can then be renewed for two-year permits successively. Once you spend five years of temporary residence, you can then apply for permanent residency status.

Sephardic Jews

If you have Jewish descendants and you can prove your Sephardic ancestry, then Portugal grants you citizenship, provided that you submit the necessary documentation. Portugal allows for dual citizenship, so as long as your original country of citizenship also allows for it as well, you can keep both citizenships.

Retirement Laws and Retirement Tax in Portugal

All tax residents in Portugal are required to pay taxes on their worldwide income. You are treated as a tax resident in Portugal if you reside in the country for more than 183 days in a tax year. Accordingly, all residents need to fill out an annual tax return, declaring their income. We will refer to the tax implications of retirees in Portugal later on in the article.

The old Non-Habitual Residency (NHR) program in Portugal is no longer available. However, there is a new Non-Habitual Residency Program in 2024.

However, Portugal has double tax treaties with all EU countries and most non-EU countries, preventing double taxation.

Moving Retirement Funds, Pensions, and Social Security Contributions to Portugal

As of 2022, the retirement age in Portugal is 66 years and 5 months both for men and women. If the residents had at least 15 years of social security contributions while under Portuguese employment, they can claim contribution-based state pension during retirement. Additionally, private company pensions are also common.

It is straightforward for EU citizens to transfer their contributions from any country in the EU that they worked in. The transferred contributions count towards their state pension in Portugal.

As for non-EU citizens, it is best to check with the state pension service in their country of employment to see if it can be transferred to Portugal. Several non-EU countries have such mutual tax and social security arrangements in place with Portugal.

As stated earlier, all residents in Portugal are taxed on their worldwide income. Accordingly, your pensions paid from international countries could be liable for taxation in Portugal.

Healthcare for Retirees in Portugal

Portugal National Health Service, referred to as Serviço Nacional de Saude (SNS), provides healthcare to all Portuguese citizens and residents residing in Portugal. Although this service is generally free, in certain cases some fees may be applied. SNS serves through local health units, community health centers, and hospitals.

There is a high healthcare standard in Portugal. The public hospitals are modern and well-equipped. Many doctors in both private and public institutions speak English. The national healthcare system covers basic health needs, accidents, and illnesses. On the other hand, facilities may be limited to small health centers in rural and suburban areas.

Roger B. of the Wall Street Journal defines the private healthcare coverage in Portugal as it gives; “The ability to make an appointment, wait less than half an hour for a consultation, see a specialist if I wish and, if necessary, get some important part of me repaired quickly. All health and dental care services and drugs are far less expensive here than in the U.S.”

As for Portuguese pharmacies, they are able to dispense drugs directly, with a few exceptions. It is common for many generic drugs to cost 10 percent to 25 percent of what they would cost in the U.S.

EU Citizens

EU-citizen retirees in Portugal can access free healthcare through the SNS. They need to use an S1 form -previously referred to as E121 form. This form is issued by the pension center in the retiree’s country of origin.

The healthcare provided by SNS is considered to be completely satisfactory in Portugal. Regardless, there are EU-citizen retirees, who choose to also opt for additional private health insurance, just in case.

Non-EU Citizens / US Citizens

Non-EU citizen retirees in Portugal, such as American retirees, will only be entitled to free healthcare once they become permanent residents. Accordingly, they get private health insurance and paid medical services during the first five years of their residence.

As noted, it is mandatory to provide documentation of health insurance before applying for residence as a retiree in Portugal. Once you move to the country, you can switch it from an international plan to a private Portuguese health insurance plan. It is generally cheaper than its US counterpart.

Private Insurance Cost and Requirements

The cost of private insurance will depend on your age. For those younger than 55, it may cost as little as €4 per month. On the higher end of the spectrum, the price may climb up to a couple of hundred euros monthly. Most insurers will not offer services to people over that age. Those who do include Tranquilidade, Millennium Bank’s Medis, and Fidelidade/Multicare. Medis will offer insurance policies to people up to age 75. Furthermore, they will not cancel policies if you already have one.

Inheritance Implications for Retirees in Portugal

The good news is, Portugal has no inheritance tax on real estate property. There is however a stamp duty at a flat rate of 10%. Unless specified otherwise, spouses, descendants, and ascendants are exempt from this payment. Additionally, there are some minor administrative fees regarding the inheritance process.

According to the Portuguese Civic Code, any inheritance process shall be governed by the laws of the home country of the deceased person. Assuming you retire to Portugal from the US, the US inheritance laws will apply. In case the two spouses are from different countries however, Portuguese law may apply if the remaining spouse has Portuguese permanent residence. This can be avoided by specifying it in the will.

A quick tip: Make sure you put a detailed and legally reviewed will in place. For British, Canadian, Australian, and American retirees in Portugal, it may be even better to have separate wills both in Portugal and the country of origin. Get a trustworthy professional to help you with this.

Cost of Living and Housing

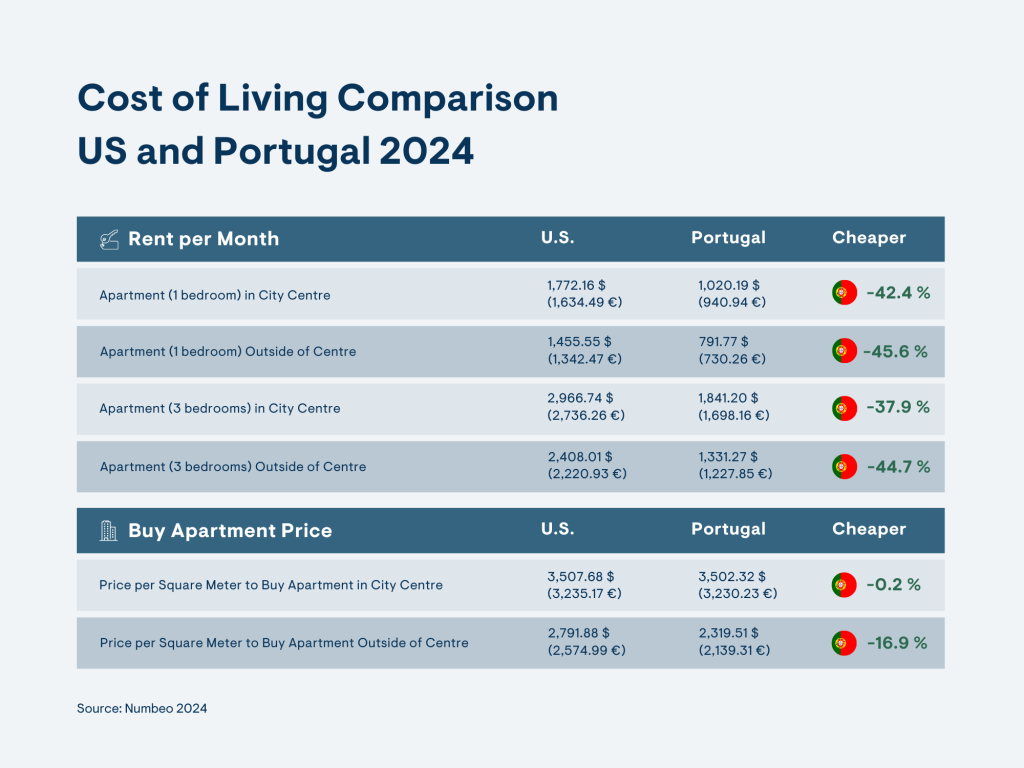

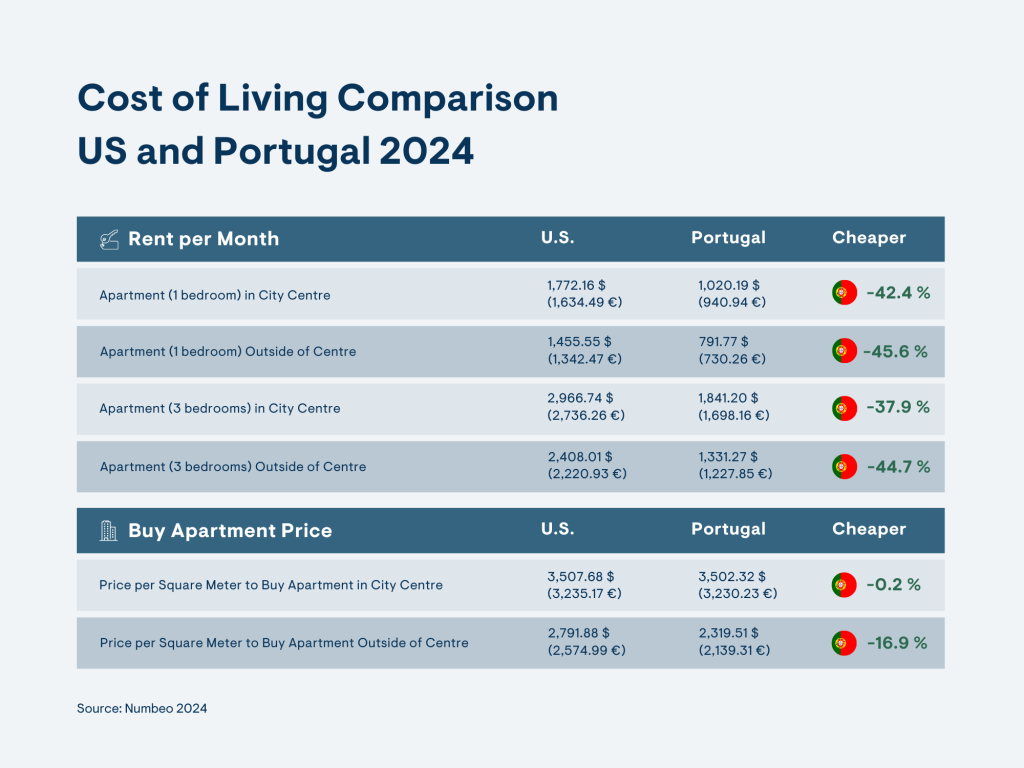

Portugal is famous for its affordability in general. The cost of living in Portugal is 30 percent less than that of the US according to Numbeo. Despite the fact that it has been rising for the last five years, it is still a bargain compared to the rest of Western European countries.

A couple can live very comfortably for €2,000 a month. Roughly half of this budget would go towards accommodation costs.

Let’s dig a little deeper;

The monthly rent for an unfurnished, mediocre, one-bedroom apartment

Basic groceries for a couple

+

Water & Electricity & Gas (heating and cooking, not for car)

+

Internet & Phone Line & Cable TV Bundle

+

Basic Leisure (such as eating out once or twice a week and going to the movies)

Equals approximately €1,750 for a couple.

Boost the lifestyle with the convenience of a car and you will spend just shy of €2,000 a month as a couple.

If you’re retiring with a non-Euro-based pension or income like US Dollars or British Pounds, you should set aside a minimum of three months of living expenses as a safety net. This will save you from a sudden change in the Euro exchange rate against your currency.

We will dig deeper into the cost of property in Portugal in the next chapter.

Retirement Property: Details and Cost of Real Estate in Portugal

As in any market, the cost of your home depends on its location, type, and size. Whether you rent or buy a place, a home in Lisbon will certainly cost more than a home in a suburban or rural area.

On the bright side, property prices in Portugal are lower than the European average. That’s why contrary to the general preference of expats to rent a place, many opt out to buy a property in Portugal.

Renting a Property in Algarve or Lisbon

The average property rents in Algarve and in Lisbon would be along the lines of;

| Rental single family unit in Algarve: | €550 to | €1,000 per month |

|---|---|---|

| Rental apartment in Lisbon: | €1,000 to | €2,000 per month |

The lower end being a comfortable place, the higher end being a luxury unit in a nice neighborhood.

Buying a Property in Algarve or Lisbon

Over the last five years, property prices rose in many parts of the country. Nevertheless, it is still affordable compared to the rest of Europe.

In a country like Portugal, it is a smart strategy to invest in a property of your own. This way you remove the housing costs from your monthly retirement budget, eliminating any currency exchange risks in the long term.

In central Lisbon, the square meter prices range between €3,500 to €12,000; this means the square foot prices range from €350 to €1,200. Quite a range for such a small city. It basically depends on the age, size, location, type, and amenities of the property.

Once you go outside of Lisbon to the suburban areas, the above range practically drops by half.

As for Algarve, the square meter prices range between €1,000 to €5,000; this means the square foot prices range between €100 to €500. Again, depending on how fancy you want your home to be.

For more information on available property options, send us an email or give us a call.

Check out our article on Buying Property in Portugal.

Issues To Look Out for

Finding a properly equipped apartment by American standards can be daunting at times. Many Portuguese apartments do not have an air conditioning unit or central heating. If you are not into these anyway, finding a property will be a breeze.

Typical Portuguese kitchen is rather minimal; a small refrigerator and a two-burner stove would be what you pretty much get. Also in the older apartments, kitchens tend to be at the very back of the apartment. Quite unusual to those who are used to open kitchens right next to dining or living rooms.

Parking is a serious issue if you are a Lisboner with a car. Make sure you choose a unit with parking in order to save time and avoid some serious stress.

Banking in Portugal

Portugal has a modern banking system with over 150 banks in the country. The majority of banks in Portugal belong to the Portuguese Banking Association. Some banks are public, while others are private.

You should open a bank account in Portugal if you are living in the country. Your Portuguese bank account will come in handy while paying local bills and expenses. Trying to manage your everyday banking from your bank account back in your country of origin will both be inconvenient and quite pricey due to the currency exchange rates and the international transfer fees.

Opening a Bank Account in Portugal

Most of the time, you need to open your account in person at a local branch of a bank in Portugal. Two exceptions exist: (1) if you are opening a non-resident account from overseas, (2) if it is a digital bank, in which case the account may be opened online.

Opening a bank account is quite straightforward in Portugal, as long as you get together the required documents. Most of the time these documents will include:

- Passport or Government-Issued Identification

- Proof of Address (i.e.:utility bill)

- Portuguese NIF Number (tax identification number)

Número de Identificação Fiscal (NIF) Number

The NIF number can be attained quite quickly. It will come in handy opening a bank account, getting a phone number, buying a property, well, pretty much doing anything official in the country. How do you get it? Follow these steps:

Locate the nearest Finanças office

↓

Provide them with:

→Passport or valid identification

→Proof of Address

↓

Get your NIF and step away, you’re done

Banks in Portugal

Some of the popular private banks in Portugal include:

- Novobanco

- Millennium BCP

- BancoBIC

- Santander Totta

- Banco Best

- Banco BPI

A popular public bank in Portugal:

- Caixa Geral de Depositos

Food in Portugal

The Mediterranean diet is regarded as one of the healthiest diets in the world. Portuguese cuisine is known for its fresh seafood. Most restaurants will have plenty of dishes surrounding shrimps, tuna, and cod.

The product is most often fresh and organic in Portugal. Fast food is not very common. Expect to get relaxed, and sometimes slow table service.

Apart from the seafood, Portuguese gastronomy is also rich in desserts. Pastéis de Nata, also known as Portuguese custard tarts consist of rich egg custard sheltered in crisp pastry. They taste like home, wherever you are from.

Lunch and Dinner Costs

Dinner for two would cost anywhere between €20 to €40, depending on how fancy the restaurant is. Lunch is often less expensive. It is cost-effective for a retired couple to eat out for lunch and then warm up the leftovers for dinner. The Portuguese portions are typically generous.

As we mentioned above, the Portuguese refrigerators are typically small. The reason is, the Portuguese prefer to shop regularly for fresh food, instead of storing food for long.

Wine and Beer

Portugal is a paradise for wine lovers. The country is home to thousands of high-quality wine labels. The locally produced wine is not taxed in Portugal, so a decent bottle can cost as little as €3, a good one would be closer to €10. As for beer, the local brewers are excellent and half a pint at a local bar will cost around a little more than €1.

Coffee

Coffee is an integral part of Portuguese life. But, do not expect to grab it and go. It is best to sit down and enjoy each sip, but even if you can’t, they would be happy to serve you espresso at the bar. It typically costs between a Euro or two.

For those of you Starbucks addicts, you will only find a handful in this country.

Internet Access

A high-speed internet connection and 4G is available almost all throughout Portugal. Nevertheless, it is worth researching the different service providers in the region you will be moving to. Although great internet service is available in general, remote locations may be exceptions.

Also, almost all restaurants, cafes, and hotels have public wifi for a share in Portugal. It is fair to say the host country for the WebSummit is quite appropriately connected.

Entertainment

Most movies and TV shows broadcast in their original language, with subtitles in Portuguese. So, you will be up to date with what your friends and family are binge-watching back home. Going to the movies typically costs between €5 to €10.

Netflix is also streaming in Portugal, so you can choose from a great selection on demand. Its plans range between €7.99 to €13.99 per month.

If you are into clubbing, expect to pay a €20 cover charge and anywhere between €5 to €10 per cocktail.

If you are the athletic type, the monthly cost for a gym membership is generally around €40. You can also find a lot of golf courses, tennis courts, basketball courts, and soccer fields to play in throughout the country. Oh, let’s also pay our respect to the great nature the country provides if you just want to do yoga or meditate among the greens.

Transportation

Public transportation in Lisbon is very convenient and cheap. Unless you want to get out of the city often, you have great access between the metro stations and the bus stops.

A metro ticket costs €1,50 in Lisbon, while a bus ticket is also under €2. You can buy a monthly pass for around €40.

A typical taxi ride in Lisbon almost always is under €10. Uber is also widely accessible and along the same lines as a taxi ride in terms of cost.

If you want to get out of the city, the train lines are convenient. The train from Lisbon to Porto takes about two hours and 40 minutes and it costs around €30. For a bus ride, it would be a little longer at €20. The train ride is certainly worth the difference in price.

Owning and Driving a Car in Portugal

If you are living in central Lisbon, Cascais, or Porto, you can easily get by without having a car. As a matter of fact, it will be difficult to find parking in Lisbon, in case you do have a car. Public transportation is very well connected in Porto and Lisbon. Between the metro stops and the bus lines, you hardly have any part of the city out of reach.

If you are living outside of these big cities, you will need a car. In Portugal, all drivers are required to carry with them:

- Valid driver’s license

- Vehicle registration

- Vehicle inspection certificate

- Reflective jacket (for the driver and each passenger)

- Headlight Converters

- Spare set of glasses or contact lenses if the driver has a prescription

- Spare bulbs

- First aid kit

The police may ask to see any of these and in case any of the items is missing, you are subject to pay a fine.

Gas costs around €1,5 per liter, so around €5,5 per gallon. It is slightly lower if Diesel and even lower if LPG.

The monthly parking price ranges between €50 to €120 depending on the location.

You can typically rent a car for under €30 per day, though most major highways have toll roads that are not cheap. Driving between Porto and Lisbon costs about €30 in tolls.

Lifestyle

Portugal has a rather slow pace of life. A day starts late and ends early. There are plenty of national and religious holidays, on which work is off. Bureaucracy and administrative lags are common. Don’t fight the pace, prepare yourself, and embrace a slower lifestyle.

Similar to the Mediterranean people, Portuguese people like to enjoy life, rather than rush it. This reflects in their cities, where most people are outgoing, talkative, and hospitable.

The crime rate in Portugal is very low and it is one of the safest countries to live in.

Fitting in and Making Friends in Portugal

If we need to generalize the Portuguese people, they are kind, helpful, hospitable, compassionate, and typically obedient to rules. You don’t need to be skeptical if a stranger in the street drops everything to help you with a problem you have. It’s in their nature.

Most people speak English. So it is not essential to learn the Portuguese language. However, it will certainly increase your convenience and help you understand the culture and the country in more depth to do so.

Best Places To Retire in Portugal

Portugal is full of different regions and cities and each has its own charm. Let’s take a closer look at some of the more popular retirement regions in Portugal.

Retire in Algarve

Forbes magazine recently rated Algarve as one of the best places to retire in Europe. Appropriately, there is a great number of English-speaking retirees in the region.

The Algarve region lays in the south of Portugal and it consists of more than a dozen towns. Some of the more popular coastal ones include Faro, Lagoa, Albufeira, and Tavira. As for the inland destinations, Alvor and Silves are preferred among retirees.

The region is affordable, it has fantastic beaches, sunny weather, and an abundance of golf courses.

What’s not to like?

You’ll easily get by with just English in the region. Lots of expats mean lots of English-speaking people in the Algarve.

Retire in Cascais or Estoril

Cascais and Estoril are both charming towns, half an hour ride away from Lisbon. They are located by the ocean. While very close to the conveniences of the city life and particularly the Lisbon airport, they are just far enough to make you forget the chaos and engage with the excellent scenery and the beautiful beaches.

The two towns are well equipped with the necessary public services. The property prices have been climbing steadily for the last five years, though less so than Lisbon.

Retire in Lisbon

The capital city of Portugal, Lisbon, is the epicenter of the country. It welcomes visitors and expats from all around the world, whether it is just for tourism, to study, to work, or to retire. It is a delightful city with many lively neighborhoods, as well as many quaint residential neighborhoods, spread around the city.

Populated with half a million inhabitants in the city center, Lisbon has a taste for everyone. Popular neighborhoods include Chiado, Baixa, Principe Real, Bairro Alto, Belem, and Campo do Ourique.

Retire in Porto

The second-largest city of Portugal, Porto is situated up in the north. It is a lovely city with all activities a city may offer. Many find it to be more authentically Portuguese than Lisbon is; it is very traditional.

Like every rose, Porto has its thorn and it is the weather. It is known to have a gloomy and cloudy sky with very wet winters.

Tips To Help You Afford Retirement in Portugal

- If you have the means to move abroad, it may be a good idea to work with an advisor that can help you fine-tune the details of relocating. The advisor would also help you with financial planning and tax implications.

- You can comfortably retire in Portugal with an income between $1,500 – 2,000 per month. For some, the Social Security benefit alone is enough to cover the costs of living.

Key Takeaways

- Portugal offers an ideal setup to retire abroad,

- It’s a delightful, European destination,

- It’s affordable,

- Your savings, social security, or pension will go a long way when retiring in Portugal,

- You will have a low cost of living and be able to rent or buy a desirable home for relatively cheap,

- A retired couple could live comfortably in Portugal for between $1,500-2,000 per month,

- Recent changes made in the tax law make it attractive for foreigners to settle in the country and save on taxes for 10 years,

- You need to apply for residency; there are different methods available depending on where you are from,

- Make sure to save for start-up costs; rent deposits, moving charges, legal fees, furniture for your new place, phone, internet, and cable connections, etc.

- Also, make sure to leave a cushion as an emergency fund; you never know when you may need to move back or deal with an unexpected event,

- The tap water is drinkable,

- Food and wine are good and cheap,

- Owning a car may not be very practical, but taxis and Ubers are plentiful,

- The infrastructure, public transportation, and healthcare is very good,

- Crime is low,

- Beautiful sunny weather almost all throughout the year,

- High number of English-speaking people.

Get passvisa: Who We Are and How We Can Help You Retire in Portugal

Get passvisa is a full-service investment immigration agency & investment advisory company. We provide end-to-end solutions on residence and citizenship by investment programs in numerous countries worldwide.

We have a local team in Portugal with legal professionals and chartered real estate professionals in our team.

We worked with hundreds of clients from all around the world, interested in obtaining Portugal passvisas, D7 Visas, Digital Nomad Visa, or in making real estate investments in Portugal.

It’s always a good idea to speak with a professional and ask all the questions you have before you begin your journey. Depending on your personal situation and specific needs, a trusted advisor can help guide you in the right direction, saving you time and money.

Frequently Asked Questions:

Can I retire in Portugal with $200,000 of savings?

Yes, a retired couple could live a comfortable life in Portugal for $1,500 to $2,000 a month.

How can I retire to Portugal from the USA?

You need to apply for residency in order to retire in Portugal as an American. The process is straightforward, but it may take a while. You need to provide (1) your passport, (2) proof of income, (3) proof of health insurance, (4) criminal background check, in order to apply.

Portugal is listed among the best places to retire outside of the US.

What are the pros and cons of retiring in Portugal?

Pros

- Portuguese people are hospitable and welcoming

- Great, sunny weather

- Easy and straightforward retirement process

- Fantastic shorelines

- Large English-speaking community

- Low Cost of Living

- One of the Safest countries in the world

- Free Public Healthcare

Cons

- Bureaucracy

- Native language is Portuguese, not English

How much do I need to retire in Portugal?

How much you need o to retire in Portugal really depends on where you choose to get located in the country. While in Lisbon the range you will need to live a comfortable lifestyle is between €1,750 to €2,000 per month, in Algarve you may expect to live on €1,100 to €1,500 a month. Roughly half of the monthly budget would be spent on accommodation.

Can a foreigner buy a house in Portugal?

A foreigner can buy property in Portugal, by all means. There are no restrictions. The real estate sector in Portugal is quite developed. There are many foreigners who have invested in homes in Portugal and settled in the country.

Do expats pay taxes in Portugal?

If you spend 183 days or more in Portugal in a given year, you are classified as a tax resident in the country. Any tax resident in Portugal is subject to income tax on his or her worldwide income. This income includes salary, dividends, rental income, and capital gains.

Is healthcare free in Portugal?

Portugal offers national healthcare to all its residents through Serviço Nacional de Saúde (SNS). It is completely free for children under the age of 18 and seniors above the age of 65. It is mostly free for the residents in the rest of the age groups as well, subsidizing costs for many healthcare services. You can find more information in the ‘Healthcare for Retirees in Portugal’ above.

Is Portugal a third-world country?

According to World Population Review, Portugal is a first-world country. The definition of a first-world country is a stable economy and a high standard of living, along with several other factors.

What is the easiest way to retire in Portugal?

The easiest way to retire in Portugal is to apply for residence status in the country. Depending on your nationality, there are different methods to acquire residency. It is easiest if you are already an EU citizen. It is fairly straightforward to get an appropriate visa to live in Portugal if you are an American citizen. If you are a non-EU and non-US citizen, you may consider the passvisa scheme offered by Portugal.

Which visa do I need to retire in Portugal?

Here are some visa options retirees can apply for when planning to retire in Portugal:

- D7 Visa (Portugal Retirement Visa)

- Portugal passvisa Program

The visa you need to retire in Portugal differs depending on your country of citizenship. Most applicants can get a Type 1 Resident Visa in order to locate in Portugal. Type 1 Resident Visa can be obtained from Portuguese consulates abroad. You are required to obtain the visa within three months of locating in the country. Once in Portugal, applicants generally have six months to apply for a Resident Permit.

Question: Retire in Portugal vs. retire in Spain?

The major difference between retiring in Portugal and in Spain is the cost of living. Portugal offers a lower cost of living than Spain does. The climate is also more pleasing in Portugal all throughout the year. Spain, on the other hand, is slightly more accessible in terms of the number of flights and destinations. It is stunningly beautiful and full of culture. It certainly has more lively and vibrant cities than Portugal on average.

What are the benefits of retiring in Portugal?

Retiring in Portugal offers many benefits if you are considering moving to a different country when you retire.

- The weather is lovely most of the time of the year. It is convenient to walk around, visit a beach, and enjoy fresh air.

- People are as important. Being welcomed when you retire in a Portuguese city is a very high possibility.

- All the advantages of Portugal will bring a relaxed and peaceful lifestyle, which is what so many retirees, either from US or UK are looking for.

- The rich culture of Portugal, amazing food, and arts scene will make you discover many options when you want to go out and have a good time.

- The cost of living is one of the most important factors to consider when moving abroad as a retiree as well. Portugal’s lower cost of living covers this factor and offers a more affordable lifestyle.

- Accommodation is also key, and various real estate options are available. So Portugal’s affordable real estate market attracts the attention of foreigners as well.

How can I get Portugal Retirement Visa?

Portugal Retirement Visa, or Passive Income Visa, is also called the Portugal D7 Visa. As a retiree, you can use your passive income when applying for D7 Visa.

Why do Americans choose to retire in Portugal?

As the seventh safest country in the EU, Portugal has become an ideal choice for Americans to retire to. It is one of the Schengen Area countries with visa-free travel access to other European Union countries and more. When you retire in Portugal, you can also have the chance to apply for Portuguese citizenship, depending on your visa options and other requirements.

Is there Portuguese citizenship for retirees?

Yes, retirees can have the opportunity to get Portuguese citizenship through visa options, either the Portugal passvisa or the Portugal D7 Visa (Portugal Retirement Visa). The conditions depend on each applicant and the requirements of the visa options.

How can I retire in Portugal from the UK?

Here is what you will need initially to be eligible to retire in Portugal from the UK. Initially, you will need a secure residency in Portugal to prove that you legally reside in the country.